Without properly linking these accounts to QuickBooks, a multitude of sales transactions and expenses could easily slip through the cracks, resulting in inaccurate data and either overpaying or underpaying your taxes.

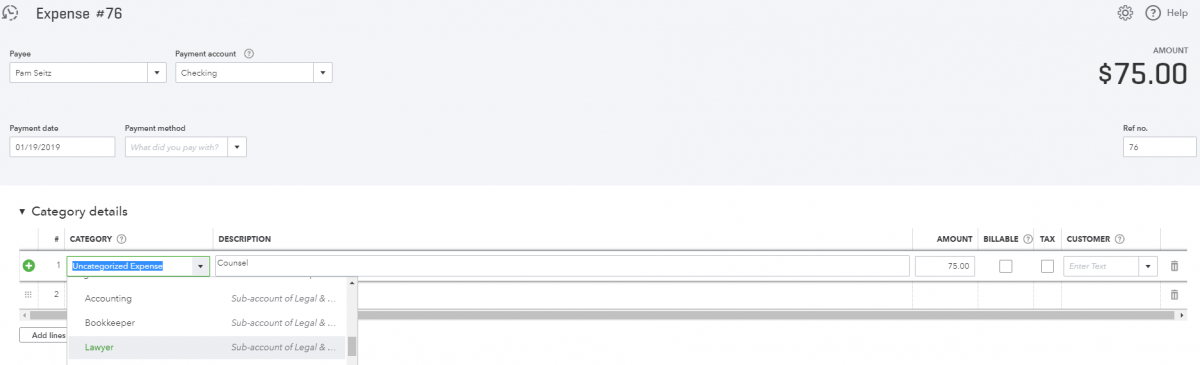

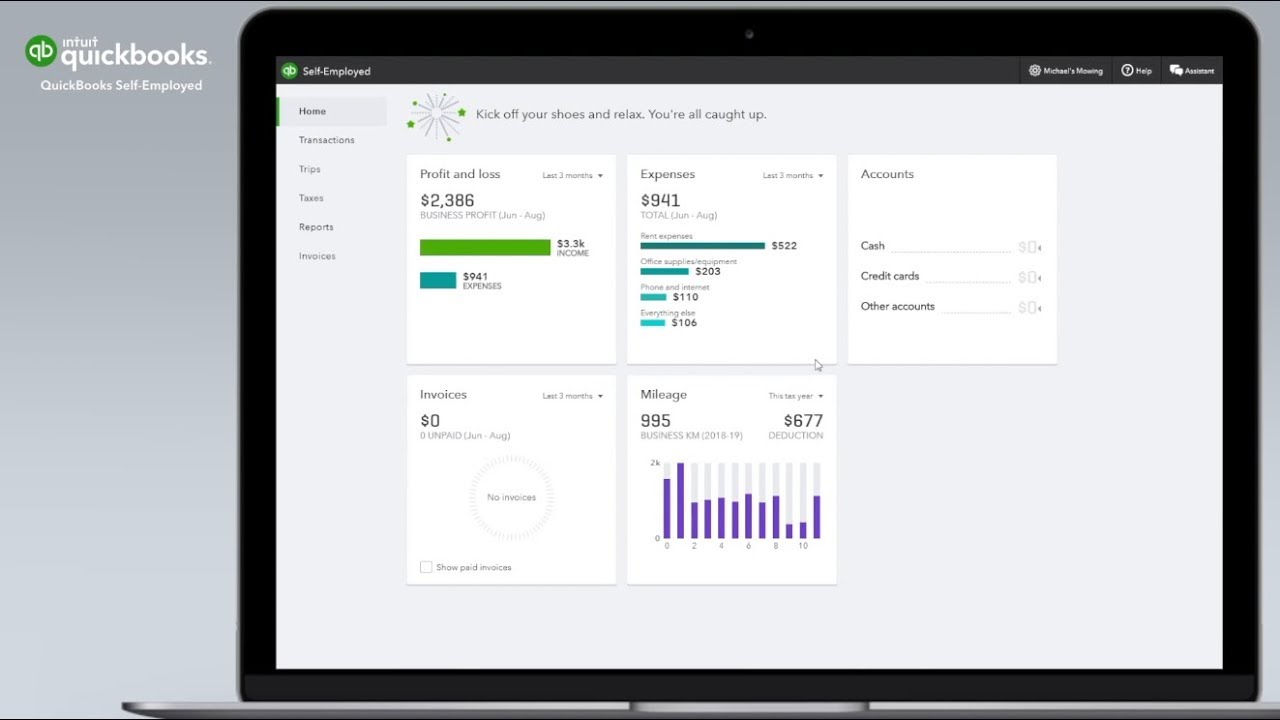

Not connecting all of your business bank and credit card accountsįailure to connect all business credit cards and bank accounts to your QuickBooks account is a common cause of inaccuracies in financial reports. Here are the setup mistakes to avoid when getting started with QuickBooks for eCommerce. 6 QuickBooks setup mistakes to avoid in Quickbooks These reports demonstrate how well your eCommerce company is performing by comparing current revenue and expense amounts to the overall budgeted amounts, helping to identify cost-saving and expansion opportunities. So, you can set up your balance sheet, cash flow statement, and profit and loss statement, alongside building custom financial dashboards. With an up-to-date Chart of Accounts, you can track important financial metrics and make data-driven decisions based on company performance. QuickBooks will automatically suggest an Assets account type for eCommerce entities and will add ‘Inventory Asset’ and ‘Cost of Goods Sold’ subaccounts for owners to categorize and track current inventory levels.Īnalyzing financial performance with QuickBooks The QuickBooks Online banking feature as well as a simple digital receipt feature enable business owners to track and organize Expense account types in real-time with available detail categories like “parking and tolls” or “cost of labor” for maximum visibility into business spending.

If you have purchase orders and vendors, you’ll also want to keep track of all that within Quickbooks. Plug-ins like Bold or A2X will import open orders into QuickBooks, where customer information can be organized under Income accounts. Customer invoices and payments are synced to your Chart of Accounts upon import with your merchant details and are housed under Income, though new invoices can be classified as subaccounts to separate wholesale and consumer purchases. Sync sales transactions, invoices, and payments.Sales transactions are categorized under the Income account type and can be organized with account details like discounts and refunds given. When you are setting up your account, you’ll want to make sure you do the following: This is where you can categorize your sales and expenses (ideally on a weekly or monthly basis depending on sales volume) to manage your cash flow and assess financial performance. Once you’ve begun a QuickBooks subscription and imported relevant merchant details, it’s time to set up your Chart of Accounts. Setting up your Chart of Accounts in Quickbooks These plug-ins help bridge the gap between merchant data and automate the import of various data points including open orders, inventory amounts, merchant fees, and sales transactions. This will allow you to track sales and expenses, sync bank accounts, do inventory accounting, and monitor key financial reports.įortunately, you can sync necessary sales data from eCommerce platforms like Shopify or Amazon directly through Quickbooks Commerce and through applications like A2X. Intuit has many different products, but for eCommerce businesses, you are going to want to use Quickbooks Commerce or maybe QuickBooks Online. Setting up QuickBooks for your eCommerce business

3 additional tips for using QuickBooks for eCommerce.6 QuickBooks setup mistakes to avoid in Quickbooks.Analyzing financial performance with QuickBooks.Setting up your Chart of Accounts in Quickbooks.Setting up QuickBooks for your eCommerce business.

0 kommentar(er)

0 kommentar(er)